A fixed interest rate home loan is one where your interest rate is locked in (i.e. fixed) for a certain period, typically between one and ten years. During the time your interest rate is fixed, both your interest rate and your required repayments won’t change. A variable interest rate home loan, on the other hand, can change at any time.And while fixed interest rates create a more predictable payment plan, they typically tend to be higher than variable rates at the moment of loan approval. Examples of Fixed Rate Loans. Common types of fixed rate loans include: Auto loans Mortgages Personal loans Federal student loans Variable Rate vs. Fixed Rate: Which Should I Choose .The key difference between the two types of loan is how the interest rate is determined for each. With variable interest rate loans, the interest rate that’s applied to the outstanding balance on the loan changes according to the market. Usually, the interest rate that’s applied is linked to an index or benchmark.

Fewer repayment costs – you can make earlier repayments or pay off your loan sooner without paying break costs. More flexibility – some variable personal loans act like a continuous line of credit. That means you can access any available funds if you need money for something else later on (there may be fees for this).A personal loan is an unsecured loan. This means that this could be used for anything you want – whether that’s a new car or renovations. The downside is that it may have a higher interest rate. A personal loan could be a fixed loan or variable loan. So by choosing a personal loan, you may have more choice available to you.Compared to variable rate loans, fixed rate loans are often more expensive. A fixed rate loan may be hundreds or even thousands of extra dollars. Fixed Interest Rate vs. Variable Interest Rate If you have a loan with a fixed rate, the interest rate and monthly payment remain the same throughout the entire loan term. Interest Rate Today: 4.

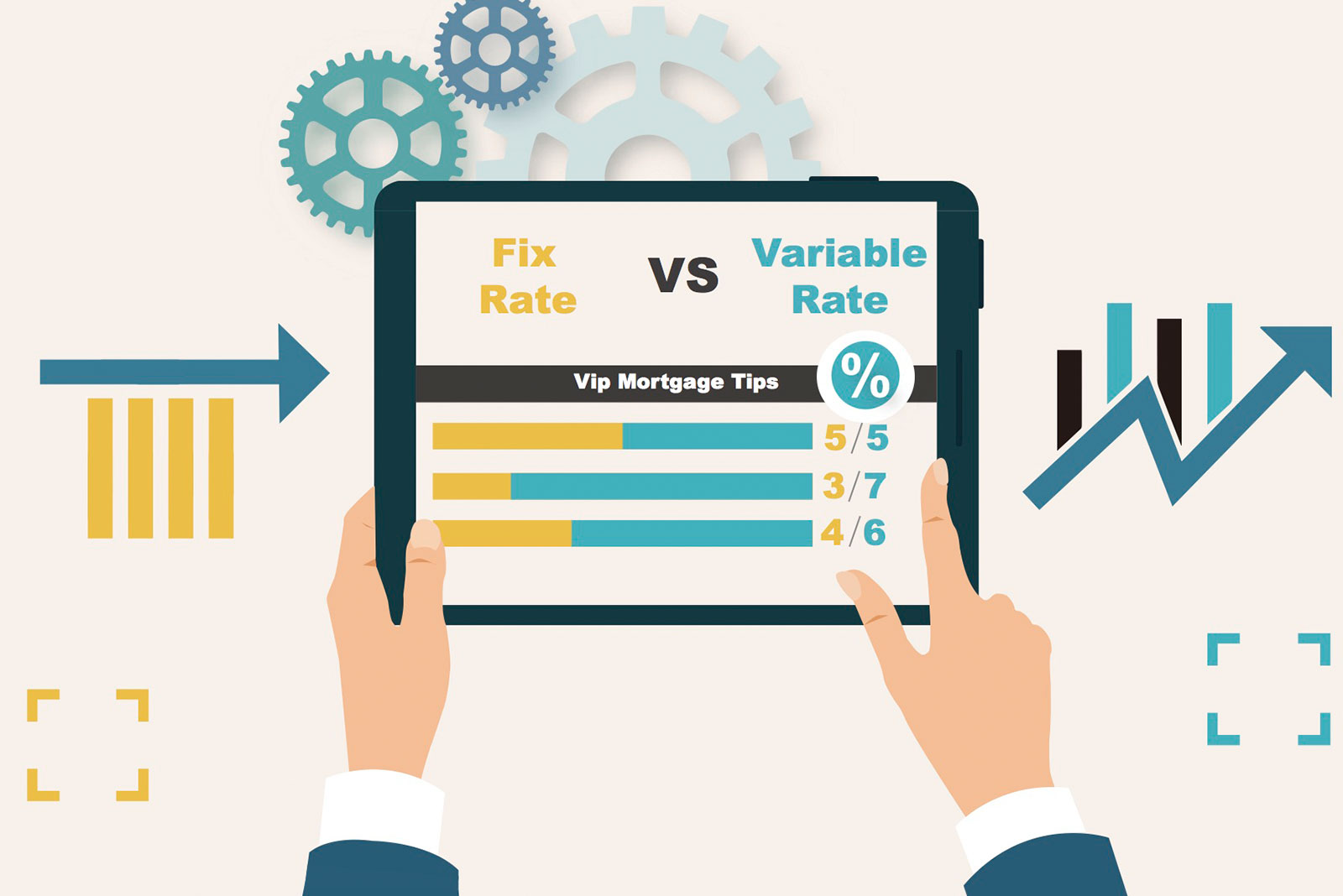

Variable rate home loans tend to be more flexible, with more features (e.g. redraw facility, ability to make extra payments) fixed rate home loans typically do not. Fixed rate home loans have predictable repayment amounts over the fixed term, variable rate home loans do not.Both fixed and variable rates are available for personal loans. A fixed rate loan has the same interest rate for the entirety of the borrowing period, while when you opt for a variable rate, it changes over time based on fluctuations in the market. Fixed rate loans are far more common than variable interest loans.Standard variable-rate penalties are only three-months’ interest – roughly $800 per $100,000 borrowed, at today’s rates. But fixed-rate mortgage penalties are usually based on the higher of .Editor’s Note: This article covers the strategies borrowers can use to convert their variable-rate federal and private loans into fixed-rate loans. For a more general discussion on inflation, check out this article on how inflation impacts borrowers. Sometimes the variable part of a variable-rate loan is a good thing. When interest rates get slashed, and payments drop, borrowers rarely complain.

Fixed Or Variable Personal Loan – If you are looking for trusted lender and lowest rates then our online service is a great choice. Self-help books for you while operating while understanding various types, duration is help right type.Fixed-rate loans generally have higher rates than the initial starting interest rate on a variable- or adjustable-rate loan. This means you’ll be paying more up front for the loan that you take on.A fixed rate allows you, as the borrower, to predict and guarantee your future payments and interest accumulation accurately throughout the term of the note. A fixed-rate loan is one interest rate secured to your loan for its entire term. Not fluctuation, no sudden changes, just one, steady rate. A variable-rate loan is tied to the market.Compare a range of fixed and variable rate personal loans Data updated regularly Reveal your potential loan offers and rates Answer two quick questions to filter the loan offers and get the best one for you. Select your credit score range Very good (740-850) Good (670-739) Fair (580-669) Poor (300-579) Finally, select where you live.

Variable rate personal loans can be used in the same ways as fixed rate loans. The key difference lies in how interest is applied. Here’s how the advantages and disadvantages of variable rate loans compare.Taking on a variable rate loan means you need to be prepared for this scenario and ensure your budget can afford bigger monthly payments. Fixed rate loans provide you with the predictability of set monthly payments. With a fixed rate loan, you can calculate the total cost of your loan because your interest rate is locked in from day one.A fixed rate loan has the same interest rate for the entirety of the borrowing period, while variable rate loans have an interest rate that changes over time. Borrowers who prefer predictable payments generally prefer fixed rate loans, which won’t change in cost.Fixed rate is a general term that can apply to different types of loans with a variety of uses, including student loans, mortgages, auto loans, and unsecured personal loans. What is the definition of a Variable Rate Loan? Variable rate loans are loans that have an interest rate that will fluctuate over time in line with prevailing interest rates.

WHAT DOES FIXED VS VARIABLE RATE MEAN? There are two options when it comes to personal loan interest rates – you can get an interest rate that is fixed, or variable. A fixed personal loan charges a fixed interest rate, therefore, your repayments will not change for the entire term of the loan. Fixed personal loans offer stability.Personal loans come with two types of interest rates: fixed or variable. Fixed interest rates remain the same throughout the entire life of the loan despite interest rate movements on the market. If you opt for a variable rate personal loan, you’re choosing a rate that will change as the market changes.For a variable interest rate personal loan, the interest rate can change, up or down, over the life of the loan. Fixed rate personal loans A fixed rate personal loan means certainty for the future. The terms of the loan are locked in and you can plan for the future knowing your interest rate and minimum repayment amounts won’t change.

Variable rate loans often look appealing compared with fixed rate loans, because their advertised interest rates tend to be lower. If you had the choice of a 6.50% fixed rate or a 4.75% variable rate, the lower rate might seem to be a great deal. But risk is involved, as the variable rate has the potential to rise during the term of your loan.Usually, variable rate personal will charge less interest than a fixed rate loan that is opened at the same time. This reduced rate is compensation for the fact that you’re accepting the risk that.Variable or Fixed Interest Rate A personal loan with a fixed interest rate will have the same interest rate for the life of the loan. This also means you’ll have the same fixed monthly payment and, based on scheduled payments, know upfront how much interest you’ll pay over the life of the loan.For personal budgeting purposes, fixed expenses are the costs that you can forecast with confidence because they don’t change from month to month or period to period. They tend to take up the largest percentage of your budget because they are things like rent or mortgage payments , car payments and insurance premiums.