A Huntington Federal lender will be happy to help you explore the best lending options for your personal needs. Call or Click to Get in Touch: 304-528-6230 | Contact Us _____ Rates, terms and conditions are subject to change. All loans are subject to credit approval. Contact Huntington Federal Savings Bank for specific eligibility requirements .Manage all of your personal bank accounts in one place, including checking accounts, savings, accounts, mortgages, and loans. Learn how to open a new personal bank account online.Turn your dreams into plans with our Personal Loan options. We offer a variety of personal loans designed to meet your individual needs. We’ll tailor your loan to finance just about anything, such as a motorcycle, a boat or RV, medical bills or debt consolidation. Get competitive rates that help turn your dreams into plans.Please Note: If you are purchasing a new home and are searching for rate and financing options, please click here to complete an Online Mortgage Payment and Rate Quote. You can also apply for a Mortgage loan by calling us at 1-888-841-6458 or by visiting your local Huntington banking office.Personal loan interest rates currently range from about 3 percent to 36 percent, depending on your credit score. As of January 31, 2022, the average personal loan interest rate is 10.28 percent .Minimum of 20% down with a maximum Loan to Value of 80%. Low Down Payment Purchase Mortgage Loans have a fixed rate and monthly payment for the entire life of the loan. Minimum of 10% down with a maximum Loan to Value to 90%. Applies only to purchase of owner occupied homes. No PMI (Private Mortgage Insurance) is required.

Consider these potential downsides before taking out an auto loan with Huntington: Origination fee. You’ll be on the hook for a $150 origination fee if you borrow through Huntington. Some car loan providers don’t charge a fee at all. Limited state availability. You need to live in one of the seven states it lends in to qualify.Huntington National Bank has failed to provide the correct Lien Release letter for Nebraska after we paid the loan in full! By law, the bank has 15 days to release the title. Huntington National Bank has had 24 15-day periods to comply and failed miserably. Huntington National Bank has refused to sign and notarize a completed Nebraska Lien .Check back here to always find an updated list of Huntington Bank promotions. Chase Coupons & Promo Codes: $100, $200, $300, $625, $2000 Bonuses For Checking, Savings, Business Accounts for April 2022. HSBC Bank Promotions: $200, $240, $500, $600, $2000 Checking Bonuses (Nationwide) – May 2022. Huntington Bank Bonuses & Promotions: $100, $300 .Huntington Bank personal loans are a good option for debt consolidation, or for people hoping to pay off their credit card or medical bills, finance a home improvement or other personal project. Loan rates vary depending on the amount, the term, and the creditworthiness of the borrower.Maximum Loan-to-Value of 80%. Low Fixed Rate. Apply online or call our loan department at 304-528-6230. Low Down Payment Purchase Mortgage Loans. Huntington Federal Savings Bank has two Low Down Payment Mortgage Loan options for customers buying a home. 10% Low Down Payment Mortgage Loan. Minimum 10% down payment.

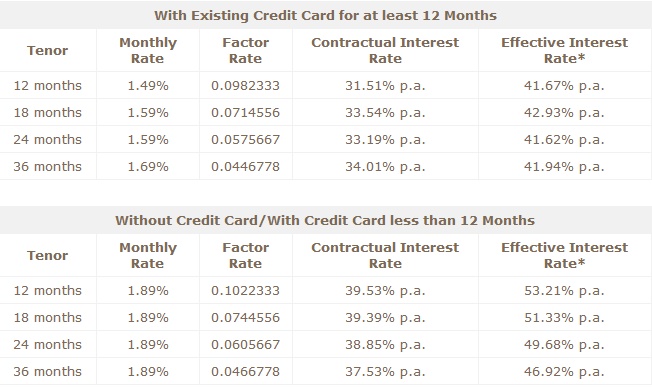

RATES ABOVE ARE AVAILABLE FOR LOAN AMOUNTS OVER $50,000 AND ARE SUBJECT TO MEETING CERTAIN UNDERWRITING CRITERIA, SUCH AS OWNER OCCUPANCY AND LOAN-TO-VALUE RATIO. YOUR RATE MAY ALSO BE DIFFERENT DEPENDING ON CREDIT HISTORY. ANNUAL PERCENTAGE RATES BASED ON $50,000 LOAN AMOUNT, INCLUDING A $150 PROCESSING FEE.I find that a personal loan from Huntington Bank is especially useful to help pay down my credit card debt. For most credit card borrowers, the interest rate on credit cards can be anywhere from 15% to 25%.Original review: May 3, 2022. Here is my view. First I was a TCF Customer since 1998. Great bank. Hungering has standby cash so with a credit score well in the 800, I spent all of the 1000 standby .However, Huntington’s rates are relatively low compared to online competitors. How Huntington Bank works. Huntington Bank is a regional bank with over 800 branches and 1,400 ATMs across seven US .The account’s $5 monthly fee can be waived if you have $5,000 combined across accounts. Huntington 25 Checking offers the highest APY among Huntington’s checking accounts. Its $25 monthly service.How to apply for a mortgage with Huntington National Bank This bank doesn’t allow online applications, but you can fill out a form to get a mortgage rate and monthly payment quote from a loan officer. This quote can be personalized if you allow the bank to check your credit report. To get a quote, follow these steps.

Find the latest Huntington Bank promotions, bonuses, and coupons for May 2022. Find your Huntington Bank offers below. Typical bonuses can range from $100, $300, $400, and up to $750.For these bonuses, customers are only required to open an eligible checking account and meet certain simple requirements.RATES AVAILABLE FOR TERMS UP TO 66 MONTHS AND FOR $3,000 OR MORE. RATES AVAILABLE SUBJECT TO MEETING CERTAIN UNDERWRITING CRITERIA. YOUR RATE MAY BE DIFFERENT DEPENDING ON CREDIT HISTORY. ANNUAL PERCENTAGE RATES BASED ON $10,000 AMOUNT FINANCED, INCLUDING A $170 PROCESSING FEE. OTHER RATES, TERMS, PAYMENTS AND LOAN AMOUNTS ARE AVAILABLE.Log in to your Huntington Online bank accounts.