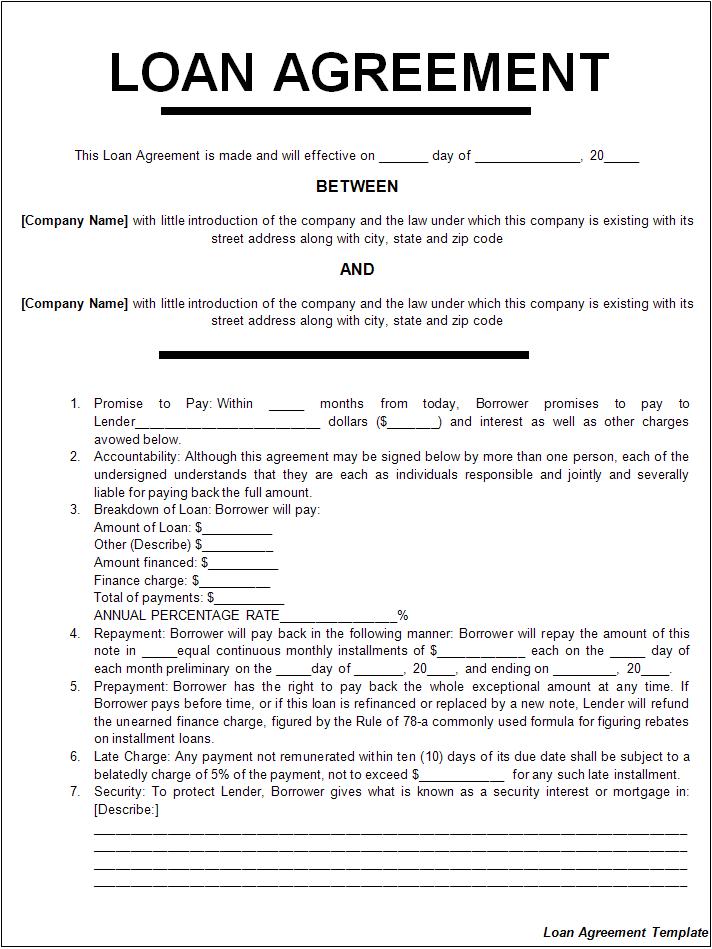

1 Collateral and Interest 2 Agree to the Terms 3 Notarize the Loan 3.1 Related You have to make a decision that if you need collateral for the safe side or you want to ask for high-interest rate. Now, it is your decision as a lender but decide it before the loan agreement.

1 Meet in person. If possible, meet face to face with your friend to discuss the loan, rather than relying on a phone conversation. Meeting in person allows you both to observe each other’s body language and tone of voice as you discuss various aspects of the loan.

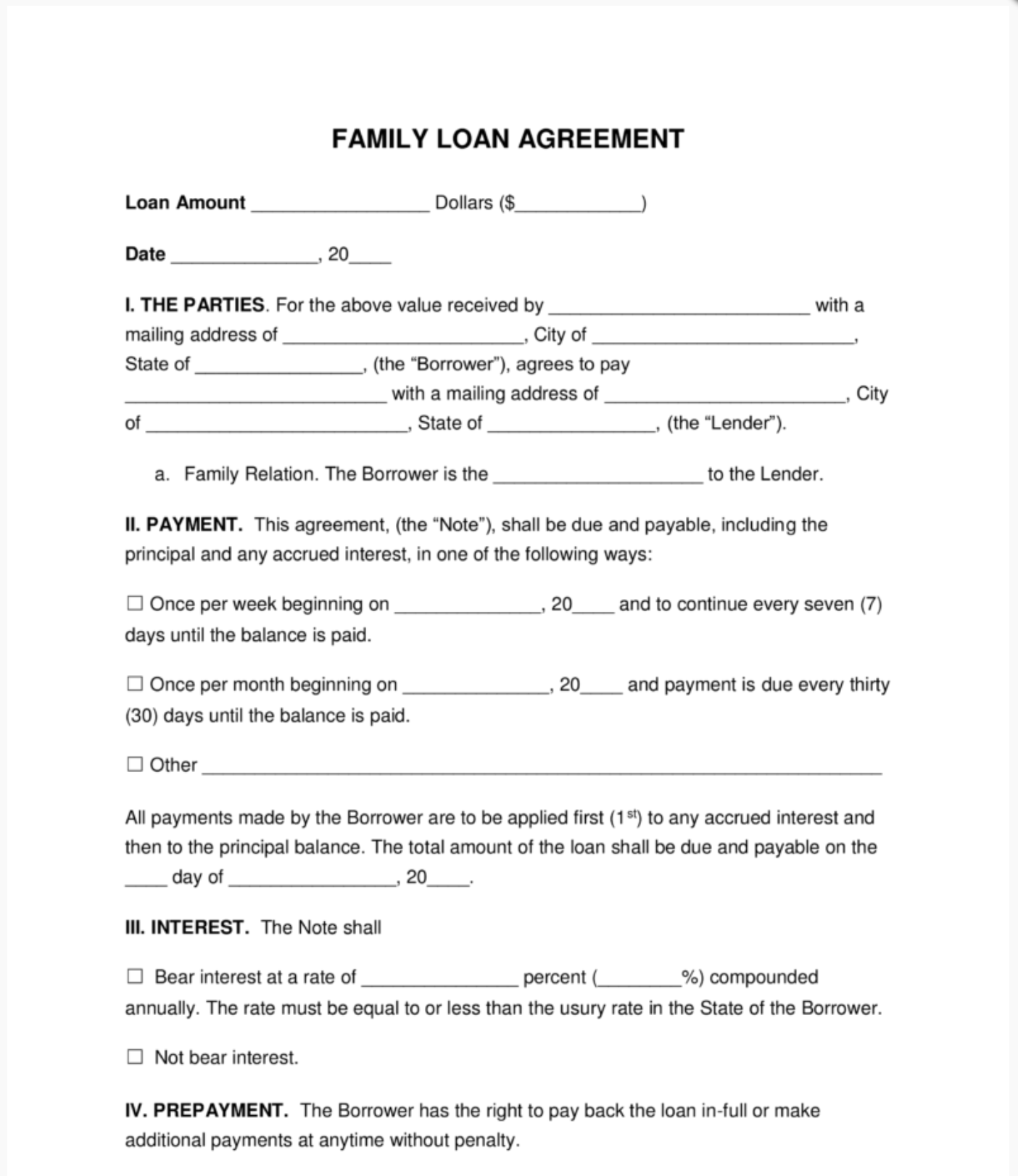

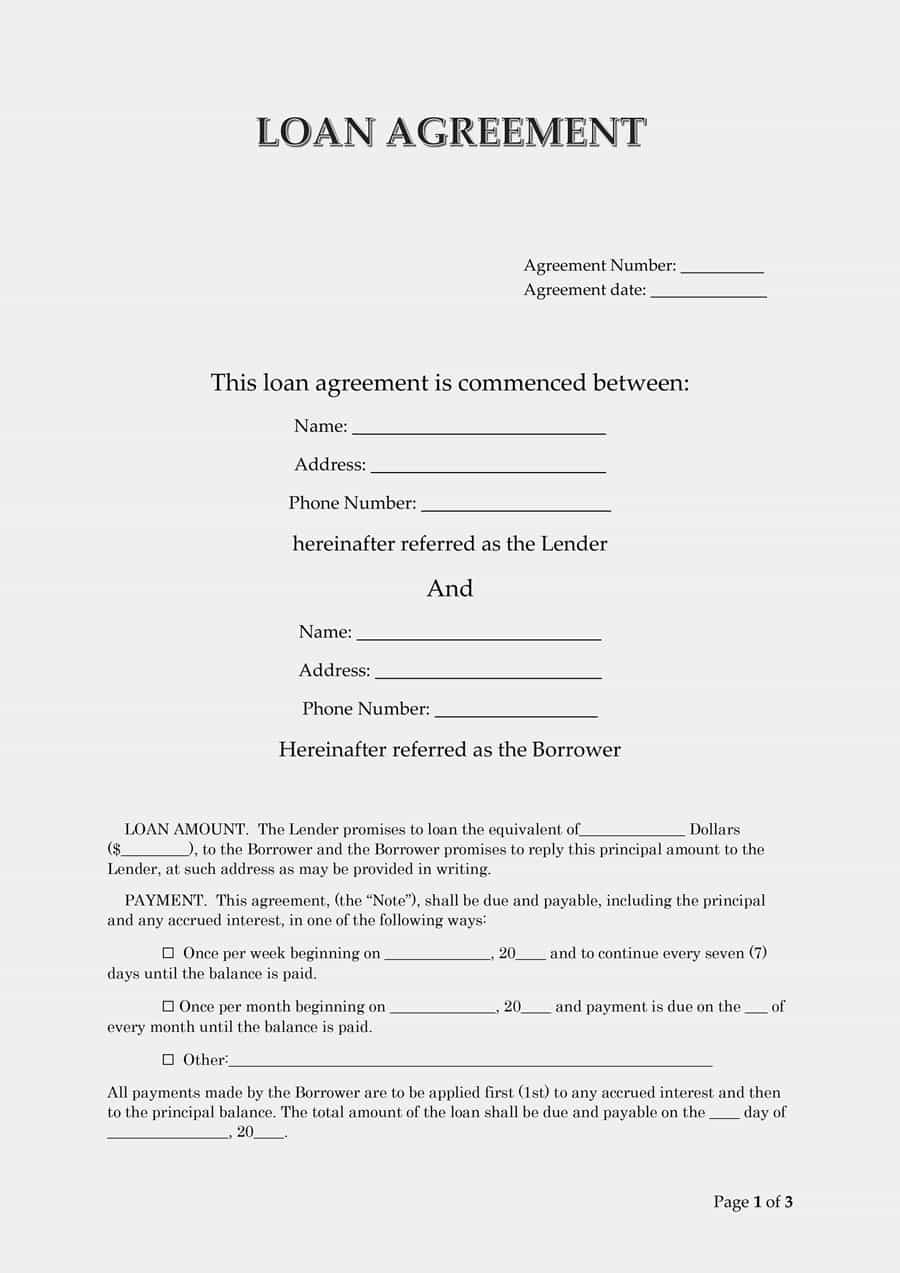

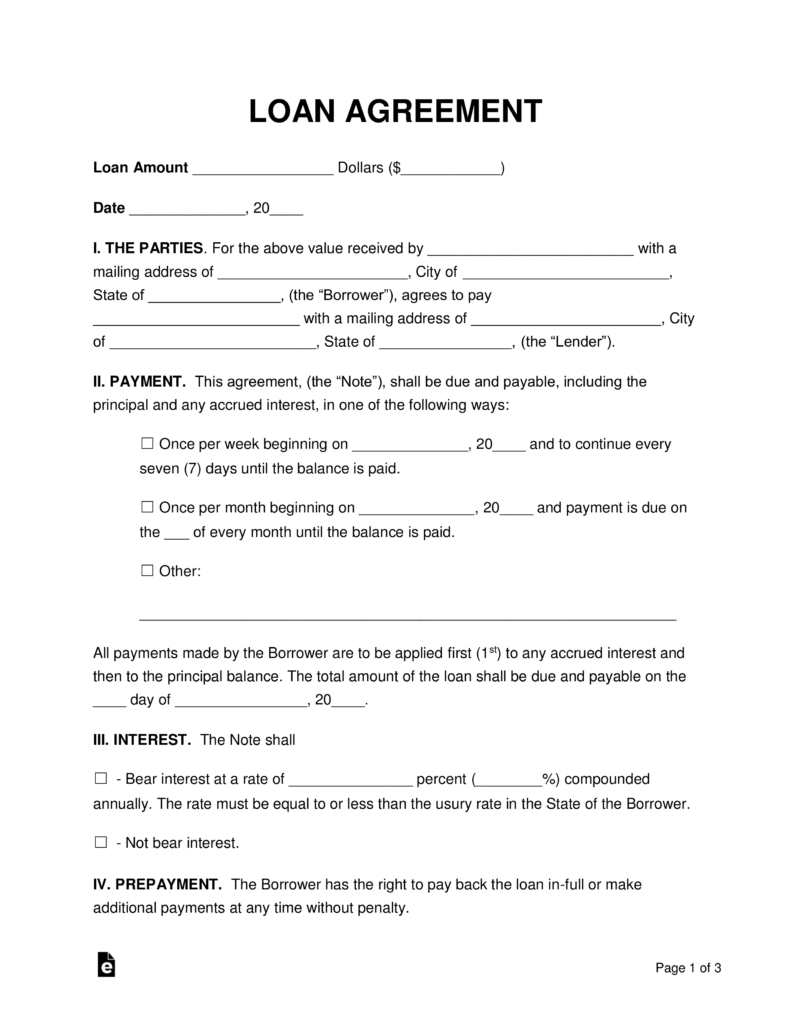

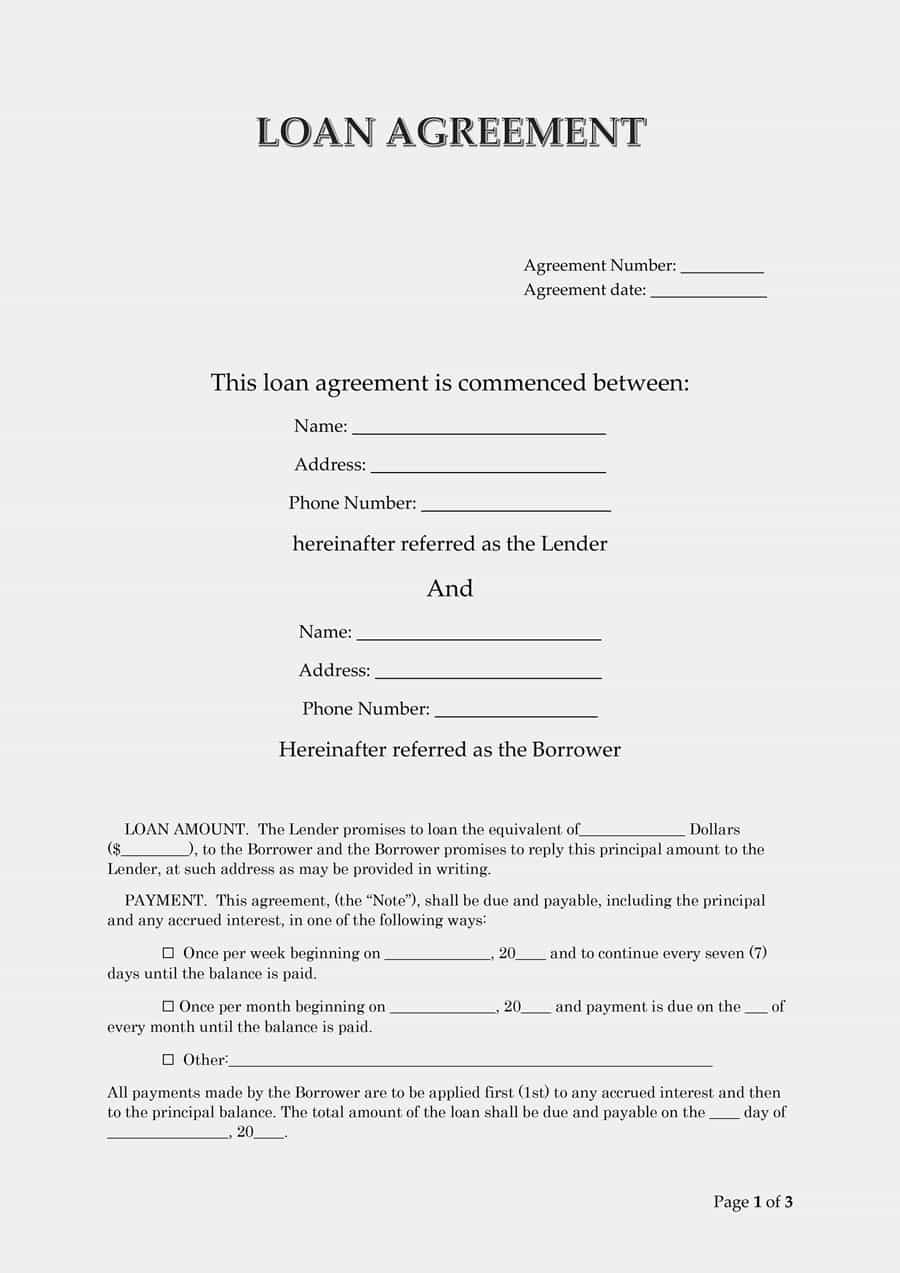

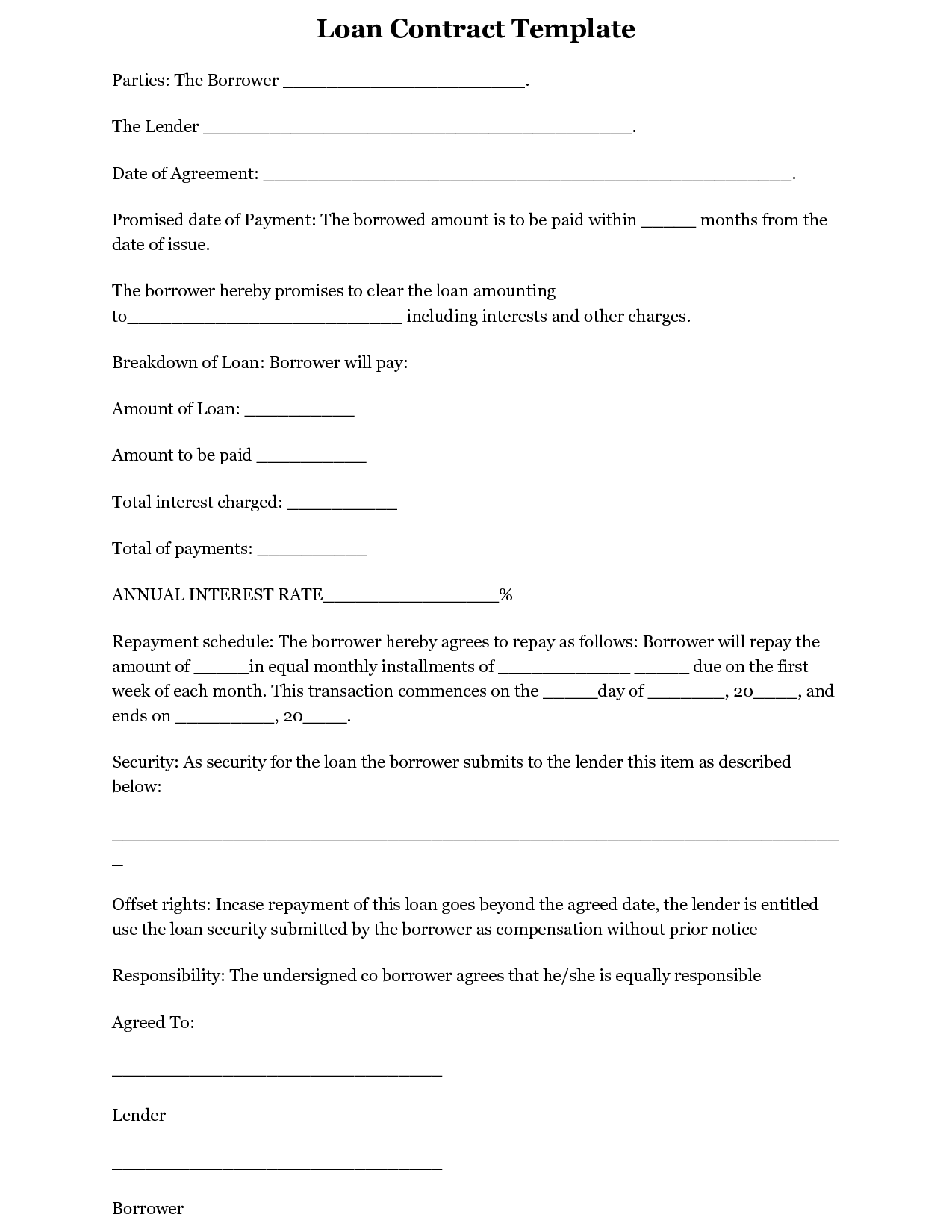

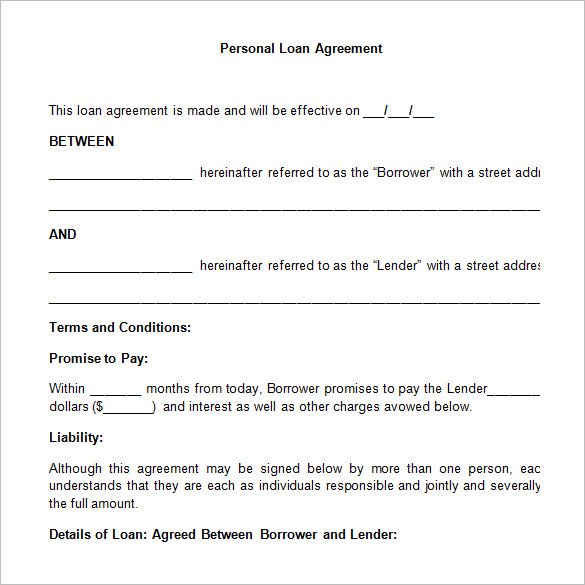

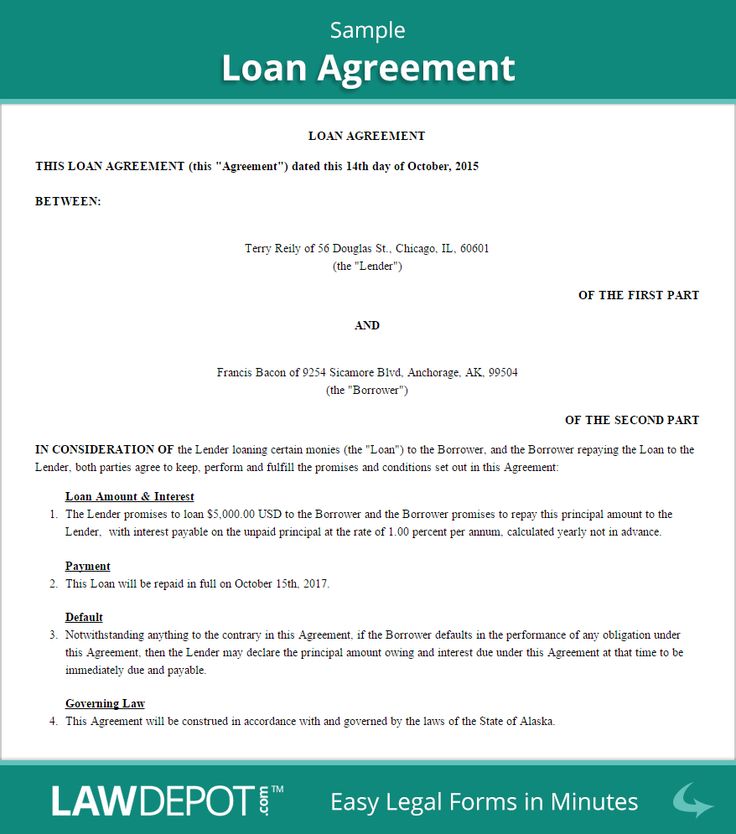

1. Clearly Identify Both Parties As Well As The Details Of The Loan The first paragraph should clearly identify the name of the lender and borrower along with the amount of money loaned and the date when the loan was originally made. For example, Darci Barton loaned Sandy Smith the amount of $2,500 on March 1, 2020. 2.

Download – http://freedownloads.net/loan-agreements/personal-loan-agreement-template/The personal loan agreement is an unsecured contract that allows one par.Analysis of your account shows that you made a personal payment prior to an insurance payment and a contractual insurance adjustment. Notification. The customer should write a letter or an email to the supplier seeking refund of the excess amount. overpayment letter to customer Published by on January 27, 2021 on January 27, 2021.

How to Get a Loan (5 steps) Choose a Loan Type Obtain/Provide Your Credit Score Secured or Unsecured Sign the Agreement Borrower Receives Money Step 1 – Choose a Loan Type Business Loan – For expansion or new equipment. If the business is new or in bad financial shape a personal guarantee by the owner of the entity may be required by the lender.

A Loan Agreement drafted for a personal loan between individuals doesn’t have to be as detailed as one involving banks, organizations or finance companies. However, it’s a good idea for individuals to have a written Loan Agreement to refer back to, so that both individual are aware of their responsibilities.

The loan agreement, or “note”, is legally binding. This document is considered to be a contract and therefore the borrower shall be expected to abide by its terms, conditions, and governing laws. Payments must be paid on-time and per the instructions of the agreement. State Usury Rates – The maximum interest rate allowed in a State.

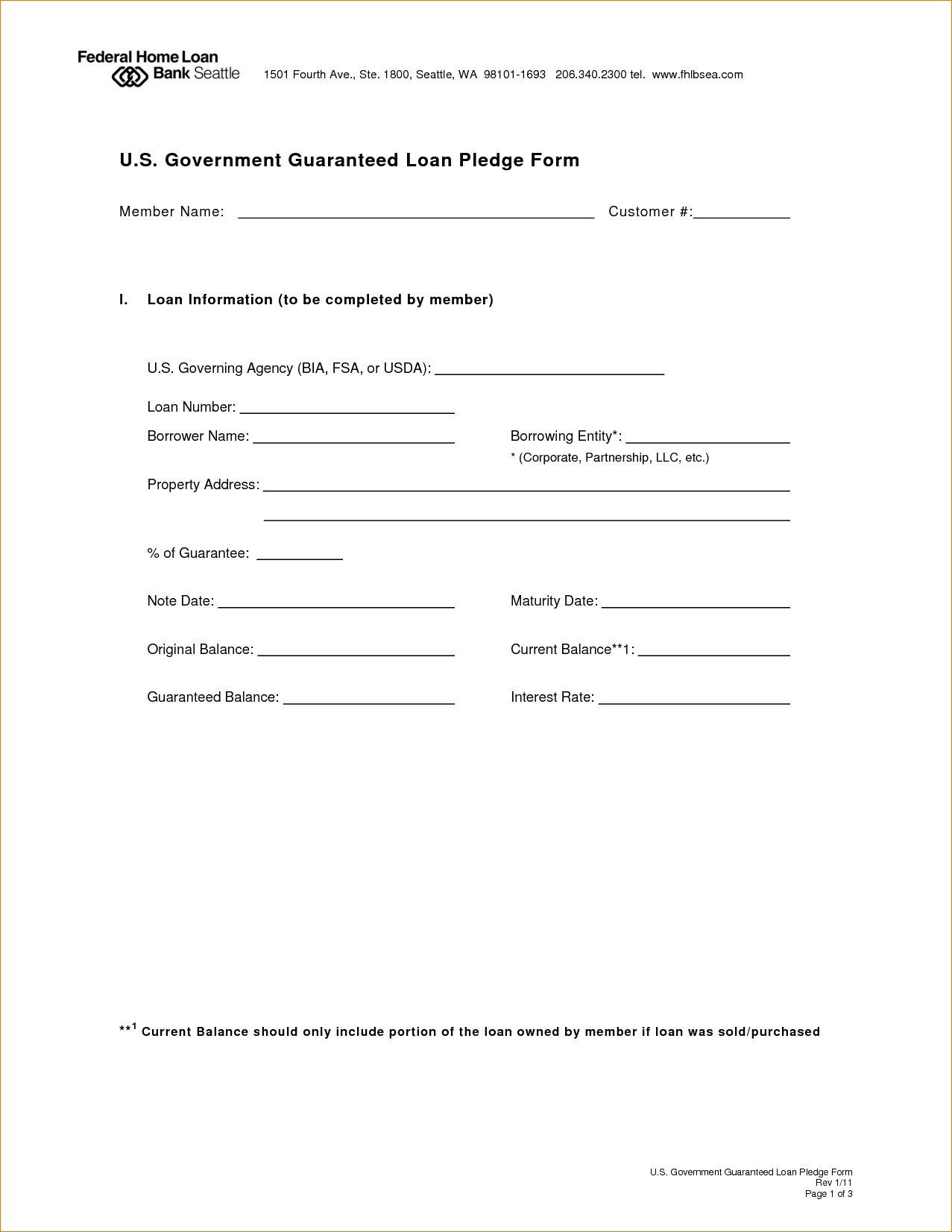

A loan agreement or loan contract is a written agreement that specifies all the details of a personal or business loan, including the amount of money or the assets being lent, the repayment terms, and what happens if the borrower defaults (is unable to pay according to the terms).

Personal loan agreements help keep messiness and uncertainty out of your financial transaction. You don’t have to be a lawyer to write a personal loan agreement. However, depending on the level of complication involved in the loan, you may want to hire a lawyer to help you with the details of the loan agreement.

Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment.

“

“