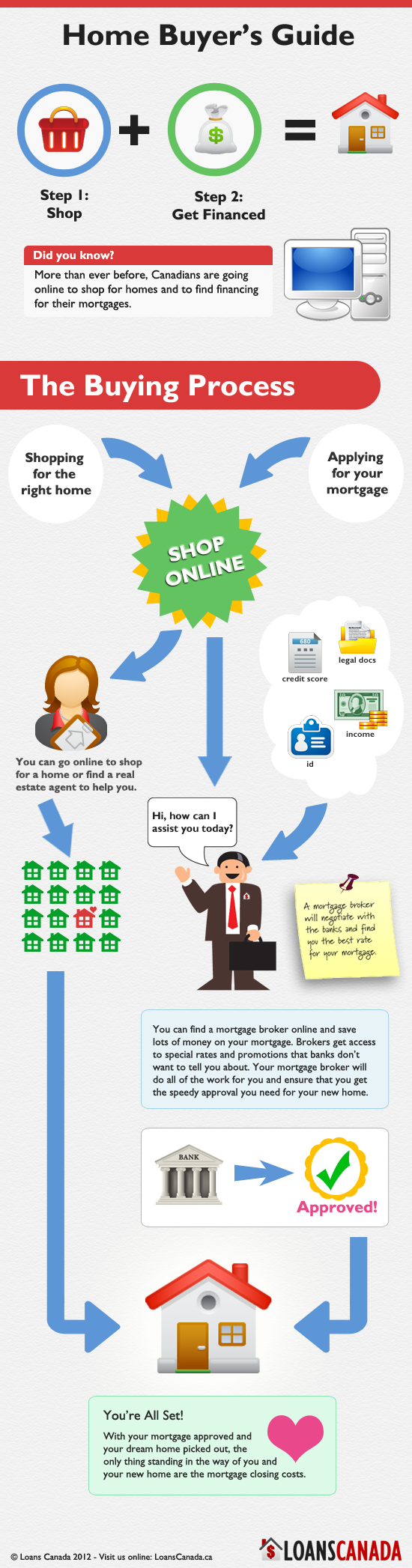

Here are four steps to get your finances in order before buying a home: 1. Get control of your credit score. While you can have less than perfect credit and still get a loan to buy property, your.Buying a car before buying a house can alter those numbers enough to keep you from getting approved for a mortgage. Consider the example below. Let’s say someone makes $3,500 a month, and they have debts totaling $450 each month. In this situation, 43% of the person’s income is $1,505.You should consider this before getting a loan if you are planning to buy a house.Taking out a personal loan to consolidate your credit cards is a way to help break the debt cycle. While you’ll then have to take out a personal loan, the interest rate may be lower than your credit cards, and personal loans usually offer fixed interest rates.Here are six things experts say you should know before taking out a personal loan. 1. Understand the application process. To get a personal loan, you will fill out a loan application and show .

Car loan refinancing is essentially opening up a new loan account to pay off your existing auto loan. If a new loan pops up on your report before applying for a mortgage, the lender might ask for a letter of explanation as to why you opened the new account. 3.If your score is below 620, you may have trouble getting approved for a conventional mortgage. To qualify for an FHA loan, you’ll need a minimum credit score of 580 to use the program’s maximum.If that homebuyer were to be approved for a home loan with a $1,000 per month house payment, his or her debt to income ratio would then become 40 percent ($2,000/$5,000=40%). In most cases, the maximum debt to income ratio that a home borrower can have and still be approved for a mortgage is 43% (including the future mortgage payment).Personal loan companies will run a credit check on you every time you apply for a product. These checks create a short-term knock on your credit score, so it’s best not to apply for too many personal loans in the months before your mortgage application. A personal loan will also affect your mortgage application negatively if you miss repayments.

Buying a new house before selling the old one Selling before buying is the way most people buy a home as the proceeds from the sale of a current home is usually required to buy a new one. Even with the the cash on hand for the down payment, it is much harder to qualify for a new mortgage while carrying debt on the existing home.You’ll need a credit score of 620+ (preferably 660+) for a conventional home loan, according to Experian. And Zillow recommends a debt-to-income ratio of 36% or less when buying a house, and no more than 50%. So, you probably can buy a house right after consolidating debt, but you may not want to.Getting a personal loan after buying a house is not difficult however, some factors must be put into consideration because they influence whether an individual can borrow money and how much they will be able to access. 1. Credit Score This is the first thing that banks and other savings Sacco look into before providing you with another loan.

The median price of a home in the United States in 2014 is around $200,000, so you will need at least $7,000 for a down payment for an FHA loan that requires 3.5% down or $10,000 for a 5% down.Every first-time homebuyer is eligible to take up to $10,000 out of a traditional individual retirement account (IRA) without paying the 10% penalty for early withdrawal. The limit is per.